A payroll tax with a 4.5 percent tax rate and exemption for income above $42,000 is

A. a progressive tax.

B. an indirect tax.

C. a regressive tax.

D. a proportional tax.

Answer: C

You might also like to view...

When there is a recession (a fall in output) and prices are increasing, and this situation is caused by adverse supply shocks, the term economists use to describe it is

A) stagflation. B) inflation. C) aggregate shifts. D) stagnation.

At any given moment, there is one exchange rate

A. for currencies in the free world. B. between every pair of currencies. C. for all the world’s currencies. D. established by the Federal Reserve Board.

Interest rates typically rise when

A. bond prices increase. B. bond prices decrease. C. the maturity date on existing bonds extends farther into the future. D. the coupon payout on existing bonds increase.

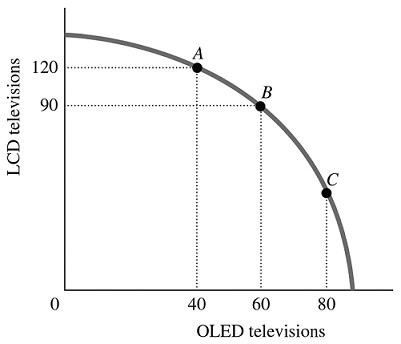

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The economy is currently at Point A. The opportunity cost of moving from Point A to Point B is the

Figure 2.5Refer to Figure 2.5. The economy is currently at Point A. The opportunity cost of moving from Point A to Point B is the

A. 30 LCD televisions that must be forgone to produce 60 additional OLED televisions. B. 90 LCD televisions that must be forgone to produce 20 additional OLED televisions. C. 30 LCD televisions that must be forgone to produce 20 additional OLED televisions. D. 120 LCD televisions that must be forgone to produce 40 additional OLED televisions.