If Josh's partnership basis was $5,000 and he received a distribution of land that had a basis of $10,000, Josh would be required to recognize a $5,000 gain.

Answer the following statement true (T) or false (F)

False

When property is distributed to a partner from a partnership, neither the partner nor the partnership recognizes any gain.

You might also like to view...

According to the text, the beta coefficient is also called the ________

A) beta factor B) beta variable C) beta element D) beta weight E) beta carotene

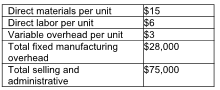

Adara's product cost per unit under variable costing is

Last year, Adara Company produced 7000 units and sold 5000 units. The company had no beginning inventory. They incurred the following costs:

A) $28

B) $24

C) $30

D) $39

Many companies use free cash flow to estimate the amount of cash that would be available for unexpected opportunities

Indicate whether the statement is true or false

In Squish La Fish v. Thomco Specialty Products, involving an adhesive that did not work as hoped in product packaging, the company that bought the adhesive sued the seller for a tort called:

a. defamation b. fraud c. intentional misrepresentation d. negligent misrepresentation e. none of the other choices