Suppose a bank has $100 million in checking account deposits with no excess reserves and the required reserve ratio is 10 percent. If the Federal Reserve reduces the required reserve ratio to 8 percent, then the bank can make a maximum loan of

A) $0. B) $2 million. C) $8 million. D) $10 million.

B

You might also like to view...

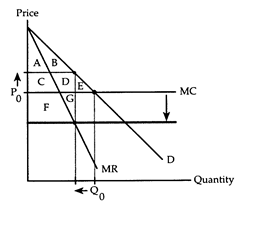

Refer to Horizontal Merger. As a consequence of the merger, consumers lose surplus equal to

The following questions refer to the accompanying diagram, which shows the effects of a horizontal merger. Before the merger, the firm behaves competitively producing Q0 and charging P0. The merger lowers the firm's marginal cost and gives the firm enough market power to switch to the monopoly equilibrium.

a. Area A + B.

b. Area C + D.

c. Area C + D + E.

d. Area G.

A lower real interest rate ________ investment spending and ________ consumption spending.

A. decreases; increases B. increases; increases C. decreases; decreases D. increases; decreases

Costumarily, economists classify resources in to these major groups:

What will be an ideal response?

How is consumer sovereignty at work at McDonald? Give an example of a hit and a miss

Please provide the best answer for the statement.