Which of the following supports the assessment that descriptive and predictive analytics benefit from a high volume of data?

a. Statistical analysis and reliability of predictions are better when the population size increases.

b. Aforecasting method with manyinput factors can predict better than the one with only a few input factors.

c. More data beats better modeling.

d. All of the above

D

You might also like to view...

Which of the following maxims in the cooperative principle is concerned with communicators offering the appropriate amount of information, given the situation?

a. quality maxim b. quantity maxim c. relevance maxim d. manner maxim

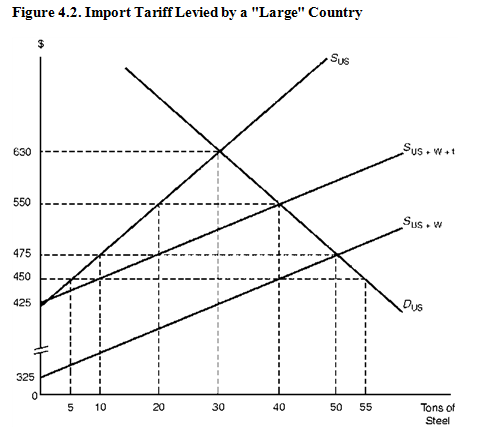

Consider Figure 4.2. With free trade, the United States achieves market equilibrium at a price of ____. At this price, ____ of steel are produced by U.S. firms, ____ are bought by U.S. buyers, and ____ are imported.

a. $450, 5 tons, 60 tons, 55 tons

b. $475, 10 tons, 50 tons, 40 tons

c. $525, 5 tons, 60 tons, 55 tons

d. $630, 30 tons, 30 tons, 0 tons

Answer the following statements true (T) or false (F)

1. In a fostering change approach, management should provide the union with full information, training, and opportunities to participate in the design and implementation of change. 2. Labor unions resistance to change can be overcome by superior bargaining power and the threat of layoffs, bankruptcies or other adverse consequences. 3. Employers who are interested in fostering change can utilize manipulation, co-optation, coercion, and negotiation. 4. Public sector budget austerity is considered another aspect of financialization of markets due to the increased influence of financial institutions on public sector financial and nonfinancial decisions.

Agro Co-op, Inc., and Bio Feed Corporation are exporting firms that join together to export a line of products. Agro Co-op and Bio Feed apply to Charter Bank for a loan to fund their effort. Under federal law, Charter and other U.S. banks are

A. encouraged by credit guaranties to lend such funds. B. discouraged by administrative rules to make such loans. C. asked by enforcement agencies to report such requests. D. banned by statute from opening such credit lines.