Homeowners can deduct interest payments on their mortgages from their federal income tax. If this deduction were removed, how would the housing market be affected?

The deductibility of these interest payments is an attractive feature of home ownership. If this deduction were removed, we would expect fewer people choosing to own their own homes. Additionally, we would expect to see more families in rental housing.

You might also like to view...

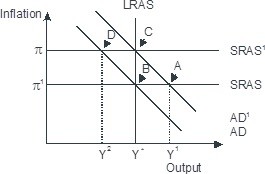

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

In perfect competition, at all levels of output the market price is the same as the firm's ________

A) marginal revenue B) normal profit C) average variable cost D) fixed cost

If the capital-labor ratio equals 1.5 in the steady state, depreciation equals 20, and dilution equals 10, investment per worker equals

A) 15. B) 20. C) 30. D) 45.

The interest rate on a bond is

A) the difference between the face value and the bond price, expressed as a percentage of the face value. B) the difference between the face value and the bond price, expressed as a percentage of the bond price. C) the ratio of the face value and the bond price, expressed as a percentage. D) the difference between the face value and the yield, expressed as a percentage of the bond price.