Suppose two economies, the United States and Saudi Arabia, each have a GDP of $1,000 . A U.S. war effort involves the purchase of $100 of Saudi oil, which is financed by selling $100 worth of U.S. government bonds to Saudi Arabia. During the war period,

a. U.S. civilian and war consumption stays at $1,000 while Saudi consumption falls to $900

b. U.S. civilian and war consumption increases to $1,100 while Saudi consumption stays at $1,000

c. U.S. civilian and war consumption increases to $1,100 while Saudi consumption falls to $900

d. U.S. civilian and war consumption stays at $1,000 and Saudi consumption stays at $1,000

e. U.S. civilian and war consumption stays at $1,000 while Saudi consumption rises to $1,100

C

You might also like to view...

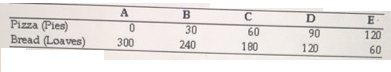

The above table shows the daily production possibilities for a bakery. Currently the bakery bakes 60 pizzas and 180 loaves of bread, that is at alternative C. Using the above table, moving from alternative C to alternative B, what is the opportunity cost of one loaf of bread?

A. 2 pizza pies

B. 1 pizza pie

C. 0.5 pizza pie

D. 30 pizza pie

Given the annual rate of economic growth, the "rule of 72" allows one to

A. determine the growth rate of per capita GDP. B. calculate the size of the GDP gap. C. determine the accompanying rate of inflation. D. calculate the number of years required for real GDP to double.

Congress passed the Freedom to Farm Act in 1996. What was the purpose of this Act?

A) to encourage more people to become farmers B) to phase out the use of price ceilings in agricultural markets C) to phase out price floors and return to a free market in agriculture D) to grant free land to farmers in order to produce crops that were particularly scarce

When the reservation wage is adjusted to account for a higher inflation rate:

a. the aggregate demand curve shifts to the right. b. the price level falls. c. the short-run Phillips curve shifts outward. d. production costs of businesses decline. e. the aggregate supply curve shifts to the right.