What differentiates a savings deposit from a small-denomination certificate of deposit (CD)?

A) A CD has a fixed maturity date; a savings deposit can be withdrawn at any time.

B) A savings deposit cannot be withdrawn before its maturity date without incurring a penalty; funds in a CD are available at any time with no interest penalty.

C) Only a savings deposit is a time deposit.

D) All depository institutions accept savings deposits, whereas only a thrift institution can issue a CD.

A

You might also like to view...

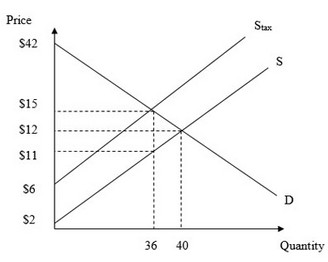

Use the figure below to answer the following question. What is the amount of consumer surplus after the government imposes the excise tax on the market?

What is the amount of consumer surplus after the government imposes the excise tax on the market?

A. $162 B. $486 C. $540 D. $144

If 11 workers can produce 53 units of output while 12 workers can produce 56 units of output, what is the marginal product of the 12th worker?

A) 0.16 B) 3 C) 4.67 D) 36

Single-owner proprietorships often unintentionally exaggerate their profits because they

A) forget their explicit losses. B) look at after-tax instead of pre-tax costs. C) pay their bills late and therefore incur large interest charges. D) neglect to consider the opportunity cost of the owner's labor.

Suppose you have $200 with which you can buy shares of stock from two companies: ABC Hot Chocolate Company and XYZ Lemonade. Each company's stock currently sells for $100 per share. If the temperature next year is lower than average, the stock price for ABC will increase by $20, and the stock price for XYZ will not change. If the temperature next year is higher than average, the stock price for XYZ will increase by $20, and the stock price for ABC will not change. There is a 50 percent chance that it will be colder than average next year, and a 25 percent chance that it will be warmer than average. If you purchase two shares of ABC stock and no shares of XYZ stock, your expected gain will be ________.

A. $40 B. $30 C. $0 D. $20