What are the roles of Federal Reserve district banks?

What will be an ideal response?

The roles of district banks include manage check clearing in the payments system; manage currency in circulation by issuing new Federal Reserve notes and withdrawing damaged notes from circulation; conduct discount lending by making and administering discount loans to banks within the district; perform supervisory and regulatory functions such as examining state member banks and evaluating merger applications; provide services to businesses and the general public by collecting and making available data on district business activities and by publishing articles on monetary and banking topics written by professional economists employed by the banks; serve on the Federal Open Market Committee, the Federal Reserve System's chief monetary policy body.

You might also like to view...

Refer to Figure 13-10. to answer the following questions

a. What is the profit-maximizing output level? b. What is the profit-maximizing price? c. At the profit-maximizing output level, how much profit will be realized? d. Does this graph most likely represent the long run or the short run? Why?

In general, one of the results of free trade is that the owners of domestically:

A. abundant factors of production win from decreased demand. B. abundant factors of production lose from increased demand. C. scarce factors of production lose due to increased competition. D. scarce factors of production win due to increased consumers.

Suppose your consumption function shifts downward. This can be caused by if the consumption function shifts downward, which of the following is the most likely cause?

A. An increase to the price level B. An increase to your disposable income C. A decrease to the interest rate D. A decrease in housing prices

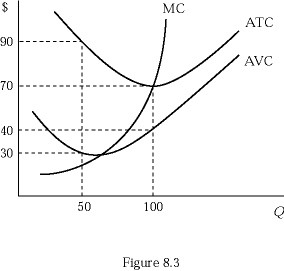

Figure 8.3 shows a firm's marginal cost, average total cost, and average variable cost curves. At Q = 100, the total cost is:

Figure 8.3 shows a firm's marginal cost, average total cost, and average variable cost curves. At Q = 100, the total cost is:

A. $2,800. B. $4,500. C. $6,300. D. $7,000.