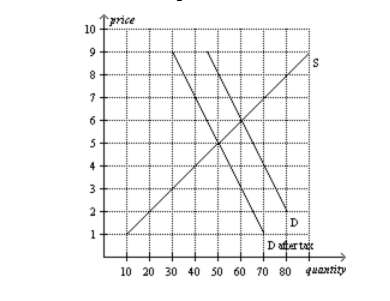

Refer to Figure 6-25. Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. After the sellers are required to pay the tax, relative to the case depicted in the graph, the burden on buyers will be

a. Larger, and the burden on sellers will be smaller

b. Smaller, and the burden on sellers will be larger

c. The same, and the burden on sellers will be the same

d. The relative burdens in the two cases cannot be determined without further information

Ans: c. The same, and the burden on sellers will be the same

You might also like to view...

Compared to a firm under perfect competition, a monopolist:

A) charges less and produces less. B) charges less and produces more. C) charges more and produces less. D) charges more and produces more.

A manager invests $400,000 in a technology that should reduce the overall costs of production. The company managed to reduce their cost per unit from $2 to $1.85 . All else equal, if the firm continues its production in the same economic environment, the firms accounting profits should

a. increase b. decrease c. stay the same d. does not affect profits

In the U.S. the percentage of the population that directly encounters poverty is exceedingly high

a. True b. False Indicate whether the statement is true or false

With discretionary policy making, fiscal and monetary policies are usually

A. immune to any lag times that might counter their effectiveness. B. set according to pre-established standards that do not take into account any changes in the economy. C. undertaken in response to or anticipation of some change in the overall economy. D. immune to any political overtones.