A wage earner making $10,000 pays

A. more in Social Security tax than in personal income tax.

B. more personal income tax than in Social Security tax.

C. about the same in Social Security tax as in personal income tax.

A. more in Social Security tax than in personal income tax.

You might also like to view...

The relationship between the level of prices and total quantity of goods and services producers are willing to supply is represented by the

A) aggregate supply curve. B) aggregate demand curve. C) sticky price curve. D) GDP multiplier.

What is supply-side economics, and how does it differ from the Keynesian emphasis on fiscal policy?

Price elasticity of demand along a linear, downward-sloping demand curve decreases as price falls

a. True b. False Indicate whether the statement is true or false

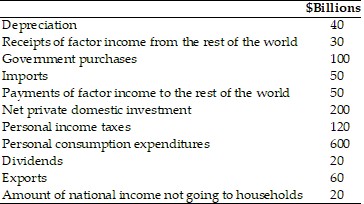

Refer to the information provided in Table 21.4 below to answer the question(s) that follow. Table 21.4 Refer to Table 21.4. The value for GDP in billions of dollars is

Refer to Table 21.4. The value for GDP in billions of dollars is

A. 910. B. 920. C. 950. D. 1,050.