In the context of each NASDAQ stock,the bid price indicates how much a market maker will pay per share to buy a stated quantity of the stock.

Answer the following statement true (T) or false (F)

True

Each NASDAQ stock has several market makers who compete against each other by posting two prices for each stock: the bid price indicates how much the market maker will pay per share to buy a stated quantity of the stock, while the ask price indicates the price per share at which it will sell the same stock. See 10-4: Issuing and Trading Securities: The Primary and Secondary Markets

You might also like to view...

When an individual considers all the ideas that come to mind when the name of a product is mentioned, which best explains the thinking?

A) maps of attitudes B) value models C) a cognitive map D) affect referral

In which dimension of a use case can latent needs appear?

a. Before use b. During use c. After use d. All of the above

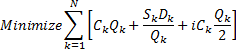

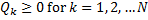

Consider the economic order quantity (EOQ) model for multiple products that are independent except for a budget restriction. The following model describes this situation.

Let Dk = annual demand for product kCk = unit cost of product kSk = cost per order placed for product k

i = inventory carrying charge as a percentage of the cost per unitB = the maximum amount of investment in goodsN = number of products

The decision variables are Qk, the amount of product k to order. The model is:

The fact that electronic data interchange technology is so expensive that only large firms can afford to use it puts small firms at a severe disadvantage when it comes to sharing information.

Answer the following statement true (T) or false (F)