Golda Rush quit her job as a manager for Home Depot to start her own hair dressing salon, Goldilocks. She gave up a salary of $40,000 per year, invested her savings of $30,000 (which was earning 5 percent interest) and borrowed $10,000 from a close

friend, agreeing to pay 5 percent interest per year. In her first year, Golda spent $18,000 to rent a salon, hired a part-time assistant for $12,000 and incurred another $15,000 in expenses on equipment and hairdressing material. Based on this information, what is the amount of her implicit costs for the first year?

A) $80,000

B) $70,000

C) $42,000

D) $41,500

Answer: D

You might also like to view...

Which of the following is likely to happen if there is an increase in entrepreneurial activity in an economy?

A) The productivity of the economy will increase. B) The inflation rate in the economy will decrease. C) The exchange value of its currency in the foreign exchange market will increase. D) The income per capita of the economy will fall.

A Nash equilibrium is a set of strategies that are mutual:

a. best responses. b. dominant strategies. c. Pareto optima. d. all of the above.

The four-firm concentration ratio for an industry is

a. the number of firms in the industry, divided by four. b. the share of industry output sold by the four largest firms in the industry. c. the percentage of total industry profits claimed by the four largest firms. d. the share of industry output sold by the fourth largest firm in the industry.

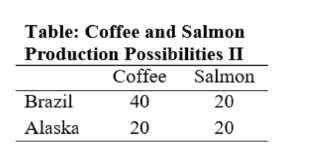

(Ref 3-3 Table: Coffee and Salmon Production Possibilities II) Use Table: Coffee and Salmon Production Possibilities II. This table shows the maximum amounts of coffee and salmon, both measured in pounds, that Brazil and Alaska can produce if they just produce one good. Brazil has a comparative advantage in producing:

A. both coffee and salmon.

B. neither coffee nor salmon

C. salmon only.

D. coffee only.