A sin tax is an example of:

A. a tax that increases the efficiency of a market.

B. a Pigovian tax.

C. government policy increasing total surplus in a market.

D. All of these statements are true.

Answer: D

You might also like to view...

The major difference in the efficacy of monetary policy relative to fiscal policy is

A) the longer recognition lag for fiscal policy. B) the shorter recognition lag for fiscal policy. C) the longer legislative lag for fiscal policy. D) the longer data lag for fiscal policy.

Microeconomics only looks at the behavior of one consumer or one firm in a market, while macroeconomics looks at the behavior of an entire industry or group of consumers

a. True b. False Indicate whether the statement is true or false

The impact of the multiplier effect is to:

a. smooth out the up and down swings of the business cycle. b. promote price stability. c. magnify small changes in spending into much larger changes in real GDP. d. reduce the impact of an increase in investment on output and employment.

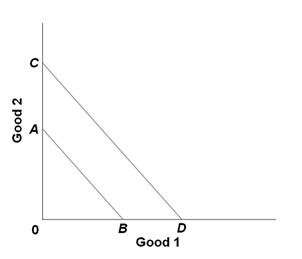

Refer to the diagram below. Cheri's budget line shifts inward from CD to AB. Which statement below is consistent with this shift?

A. Both prices double, while her income also doubles

B. Both prices increase by 20 percent, while her income increases by 15 percent

C. Both prices decrease by 10 percent, while her income falls by 15 percent

D. Both prices decrease by 10 percent, while her income falls by 6 percent