Why is limited liability so important when firms try to raise large amounts of financial capital? How is this advantage of a corporation tied to a disadvantage of a corporation?

What will be an ideal response?

Limited liability is important in raising large funds because the owners (stockholders) know that the total liability they have connected with the firm is limited to the investment they made in buying the shares of stock. It is easier to get people to buy a portion of the firm when their liability is limited. But, this large group of owners also means that the diverse ownership may make it difficult to monitor the performance of the management team.

You might also like to view...

Which of the following statements is correct?

A) assets plus liabilities equal net worth B) assets plus net worth equal liabilities C) assets equal liabilities plus net worth D) liabilities minus net worth equal assets

Explanations for the decline in U.S. productivity in the 1970s and 1980s include all of the following except:

a. difficulties with measuring service sector output. b. the entry into the labor force of many young, inexperienced workers. c. a wave of corporate mergers that reduced competition. d. rising oil prices.

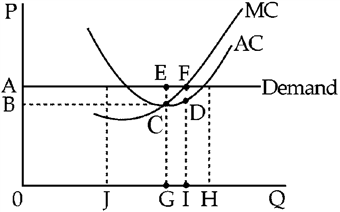

Figure 10-3

In Figure 10-3, the perfectly competitive firm is realizing a

a.

loss equal to ABCE.

b.

profit equal to ABCE.

c.

profit equal to ABDF.

d.

loss equal to ABDF.

Increased opportunities for trade increase production by

A. Protecting countries from competition. B. Shifting the production possibilities curve outward. C. Encouraging countries to be self-sufficient. D. Improving efficiency through specialization.