Solve the problem. Refer to the table if necessary. Kevin is married, but he and his wife filed separately. His gross salary was $34,707, and he earned $466 in interest. He had $1848 in itemized deductions and claimed three exemptions for himself and two children. Find his taxable income.

Kevin is married, but he and his wife filed separately. His gross salary was $34,707, and he earned $466 in interest. He had $1848 in itemized deductions and claimed three exemptions for himself and two children. Find his taxable income.

A. $14,825

B. $22,925

C. $24,773

D. $16,673

Answer: D

You might also like to view...

What is the formula for the present value of an ordinary annuity of 1?

A.

B.

C.

D.

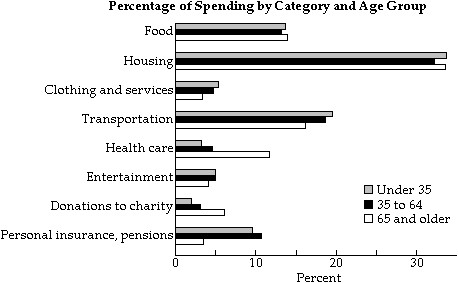

Determine whether the spending pattern described is at, above, or below the national average. Assume that any salaries or wages are after tax.  A single 42-year old woman with a monthly salary of $3700 spends $1200 on rent.

A single 42-year old woman with a monthly salary of $3700 spends $1200 on rent.

A. below average B. at average C. above average

Solve the problem.Suppose you start saving today for a  down payment that you plan to make on a house in 10 years. Assume that you make no deposits into the account after your initial deposit. The account has quarterly compounding and an APR of 3%. How much would you need to deposit now to reach your

down payment that you plan to make on a house in 10 years. Assume that you make no deposits into the account after your initial deposit. The account has quarterly compounding and an APR of 3%. How much would you need to deposit now to reach your  goal in 10 years?

goal in 10 years?

A. $15,490.39 B. $14,832.96 C. $12,342.98 D. $9495.49

Provide an appropriate response.Simplify: |-8|

Fill in the blank(s) with the appropriate word(s).