Relative to the current year, the sales manager's proposal will ________.

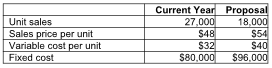

Alvarez Company is facing an $8 increase in the variable costs of producing one of its products for the upcoming year. As a result, the sales manager has made a proposal to increase the sales price of the product while increasing the advertising budget at the same time. The sales price increase will lower sales volume, but the other changes may help the company maintain its profit margin. Alvarez has provided the following information regarding the current year results and the proposal made by the sales manager:

A) decrease operating income by $324,000

B) increase contribution margin by $196,000

C) decrease the unit breakeven point

D) decrease operating income by $196,000

D) decrease operating income by $196,000

You might also like to view...

Identify a legal violation that occurs when someone intentionally interferes in the private affairs of another when the interference would be "highly offensive to a reasonable person."

A. Conflict of interest B. Defamation C. Intrusion into seclusion D. Battery

Attorneys are required to find relevant law that is applicable to a case and can be discovered through a reasonable amount of research

Indicate whether the statement is true or false

Intellectual property consists of which of the following?

A) Trade secrets B) Patents C) Trade symbols D) All of these are considered intellectual property.

Mangrum Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. Information concerning the direct labor standards for the company's only product is as follows:InputsStandard Quantityor HoursStandard Price or RateStandard CostDirect labor0.70hours$21.50per hour$15.05During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 12,790 hours at an average cost of $19.50 per hour. The company calculated the following direct labor variances for the year: Labor rate variance$25,580FLabor efficiency variance$6,450FAssume that all transactions are recorded on the below

worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.?CashRaw MaterialsWork in ProcessFinished GoodsPP&E (net)?1/1$1,130,000$23,940$0$87,870$526,400=?Materials Price VarianceMaterials Quantity VarianceLabor Rate VarianceLabor Efficiency VarianceFOH Budget VarianceFOH Volume VarianceRetained Earnings1/1$0$0$0$0$0$0$1,768,210When recording the direct labor costs, the Cash account will increase (decrease) by: A. $249,405 B. ($281,435) C. ($249,405) D. $281,435