Does a tax on sellers affect the demand curve?

A. No, there is change in the quantity demanded, but the demand curve does not move.

B. Yes, it shifts to the left by the amount of the tax.

C. Yes, it shifts to the right by the amount of the tax.

D. Yes, it shifts up by the amount of the tax.

Answer: A

You might also like to view...

The free rider problem is an economic issues associated with

a. Public Goods b. Negative externalities c. Social cost d. Marginal Benefits

The chartering process is similar to ________ potential borrowers and the restriction of risk assets by regulators is similar to ________ in private financial markets

A) screening; restrictive covenants B) screening; branching restrictions C) identifying; branching restrictions D) identifying; credit rationing

Country A has twice as many workers as Country B. Country A also has twice as much physical capital, twice as much human capital, and access to twice as many natural resources as Country B. Assuming constant-returns to scale, which of the following is higher in Country A?

a. both output per worker and productivity b. output per worker but not productivity c. productivity but not output per worker d. neither productivity nor output per worker

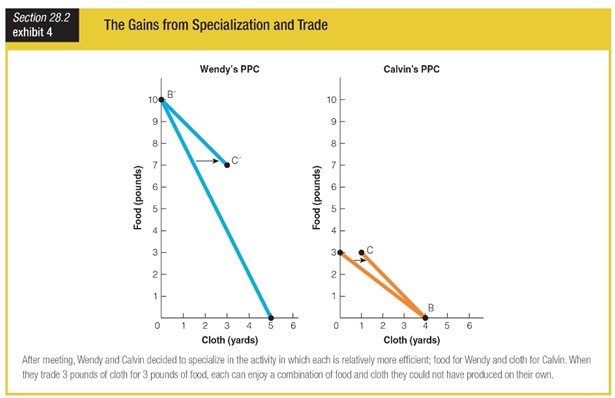

Which of the following is an outcome of trade depicted in Exhibit 4?

a. Through trading with Calvin, Wendy’s food production has declined from 10 pounds to 7 pounds per day.

b. The exchange has been unfair to Wendy because a pound of her food is more valuable than a pound of Calvin’s cloth.

c. The exchange has been unfair to Calvin because he has only 3 pounds of food, whereas Wendy has 7 pounds.

d. Wendy and Calvin each enjoy a larger combination of food and cloth than they could have produced alone.