The multiplier is reduced by an income tax because an income tax reduces the fraction of each dollar of GDP that consumers actually receive and spend.

Answer the following statement true (T) or false (F)

True

You might also like to view...

The amount of a tax paid by the buyers will be larger the

A) more elastic the demand and the more inelastic the supply. B) more inelastic the demand and the more elastic the supply. C) more inelastic are both the supply and demand. D) more elastic are both the supply and demand.

Diversifying

a. increases the standard deviation of the value of a portfolio indicating its risk has increased. b. increases the standard deviation of the value of a portfolio indicating its risk has decreased. c. decreases the standard deviation of the value of a portfolio indicating its risk has increased. d. decreases the standard deviation of the value of a portfolio indicating its risk has decreased.

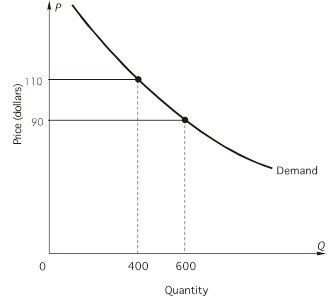

Refer to the following graph to answer the question: The price elasticity of demand over the price interval $90 to $110 is

The price elasticity of demand over the price interval $90 to $110 is

A. -2.0 B. -1.0 C. -0.5 D. -1.5 E. -0.4

Issues of the distribution of goods and services and incomes in a competitive market system are the primary topic of which fundamental question?

A. How will the system promote progress? B. Who will get the goods and services? C. How will the goods and services be produced? D. What goods and services will be produced?