Financial markets are:

A. in many ways the purest expression of the market mechanism.

B. a powerful tool for the efficient allocation of scarce resources.

C. a global marketplace where sophisticated investors make billion-dollar decisions.

D. All of these statements are true.

D. All of these statements are true.

You might also like to view...

If the Federal Reserve announces that its target for the federal funds rate is falling from 3 percent to 2.25 percent, how do you expect workers and firms to react?

A) As long as the Fed's announcement is credible, workers and firms will increase their consumption and investment spending, which will increase aggregate demand and inflation. B) As long as the Fed's announcement is credible, workers and firms will decrease their consumption and investment spending, which will decrease aggregate demand and inflation. C) Workers and firms will incorporate the decrease in interest rates into their expectations of inflation, and they will expect inflation to fall as a result of Fed's policy announcement. D) If the Fed's announcement is not credible, workers and firms will not expect inflation to rise so they will increase their consumption and investment spending, which will decrease aggregate demand and increase inflation.

The Federal Reserve district banks

A) do not engage in monetary policy. B) engage in monetary policy directly through discount lending. C) engage in monetary policy directly through open market operations. D) engage in monetary policy directly through their membership on Federal Reserve committees.

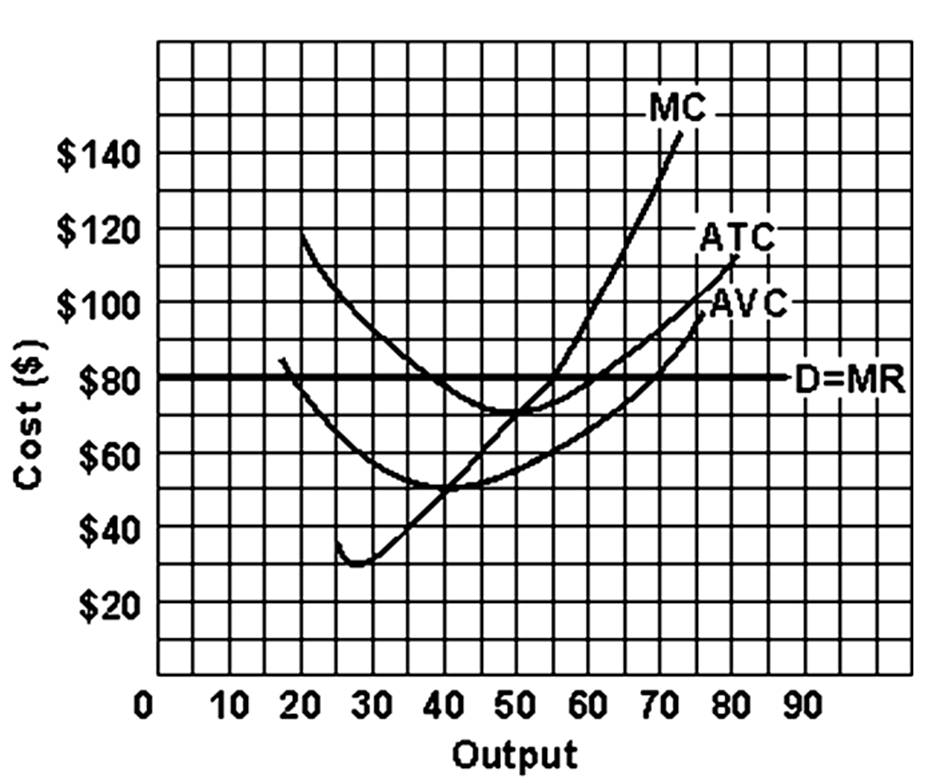

The firm's break-even point occurs at an output of

A. 40.

B. 45.

C. 50.

D. 55.

Define the following terms and explain their importance to the study of macroeconomics: a. Aggregation b. Recession c. Gross domestic product d. Final goods and services e. Stabilization policy

What will be an ideal response?