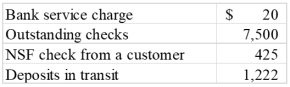

The unadjusted cash account balance for Carson Company at December 31 is $12,615. The bank statement showed an ending balance of $18,250 at December 31. The following information is available from an examination of the bank statement and the company's accounting records: Check #433 for the purchase of inventory was written correctly and paid by the bank correctly for $432, but was recorded on the books at $234. Carson uses the perpetual inventory system.Required:a) Determine the true cash balance by preparing a bank reconciliation as of December 31.b) Record in general journal form any necessary entries to the Cash account to adjust it to the true cash

Check #433 for the purchase of inventory was written correctly and paid by the bank correctly for $432, but was recorded on the books at $234. Carson uses the perpetual inventory system.Required:a) Determine the true cash balance by preparing a bank reconciliation as of December 31.b) Record in general journal form any necessary entries to the Cash account to adjust it to the true cash

balance.

What will be an ideal response?

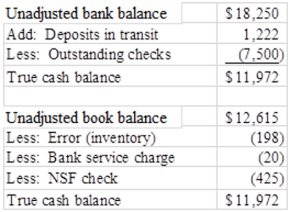

a)

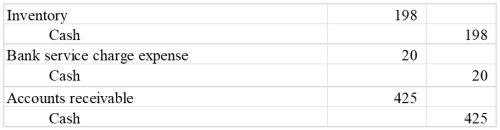

b)

b) Entries must be recorded for the adjustments to the unadjusted book balance so that the adjusted cash balance equals the true cash balance. Entries are not recorded for the adjustments to the unadjusted bank balance since these items are already reflected in the company's books.

You might also like to view...

Changing inventory methods to take advantage of the tax breaks offered by LIFO is not a valid reason for a change in methods

a. True b. False Indicate whether the statement is true or false

Which of the following is one of the main advantages of using statistical reports as the source of information?

A. Statistical reports can be used to obtain firsthand knowledge. B. Unfiltered information can be obtained using statistical reports. C. Statistical reports are effective for showing relationships. D. Statistical reports allow verbal and non-verbal feedback.

The evidence on core self-evaluations shows that your concept of self-worth will likely translate into ______.

A. narcissism B. risk-taking C. net worth D. stress

Answer the following statements true (T) or false (F)

The accounting profession has been regulated by Congress since the 1880s when it became clear that accounting was an important instrument in America for conducting business.