In Florida, sunscreen and sunglasses are vital items

If the tax on sellers of these items is doubled from 5.5 percent to 11 percent, who will pay most of the tax increase: the buyer or the seller? Will the tax increase halve the quantity of sunscreen and sunglasses bought?

Because sunscreen and sunglasses are necessities, the demand for them is inelastic. So, most of a tax imposed on them will be paid by the buyer. Even though the tax doubles, the quantity purchased is not halved because the demand is inelastic.

You might also like to view...

Refer to the above figure. Which of the following would allow society to move to point d?

A) producing efficiently B) concentrating production in wheat C) increasing the quantity of labor D) using the best land to produce wheat and the lower quality land to produce beans

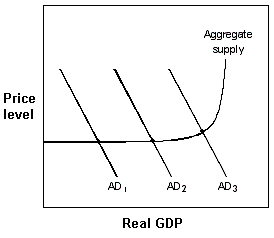

Exhibit 20-4 Aggregate demand and supply model

?

A. raise the legal reserve requirement B. lower the discount rate C. increase the federal funds rate D. sell government securities

The legislation which outlawed asset-purchase mergers that would substantially reduce competition was the:

A. Sherman Act. B. Clayton Act. C. Robinson-Patman Act. D. Celler-Kefauver Act.

Price floors are

A. sometimes associated with surpluses. B. always associated with surpluses. C. sometimes associated with shortages. D. always associated with shortages.