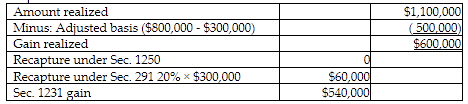

Octet Corporation placed a small storage building in service in 2002. Octet's original cost for the building is $800,000 and the cost recovery deductions are $300,000. This year the building is sold for $1,100,000. The amount and character of the gain are

A) ordinary gain of $60,000 and Sec. 1231 gain of $540,000.

B) ordinary gain of $300,000 and Sec. 1231 gain of $300,000.

C) ordinary gain of $600,000.

D) Sec. 1231 gain of $600,000.

A) ordinary gain of $60,000 and Sec. 1231 gain of $540,000.

The Sec. 291 recapture equals 20% of the recapture that would have been required if Sec. 1245 had applied less the amount recaptured under Sec. 1250 [20% of (300,000 - 0)].

You might also like to view...

The another interpretation of the accounting equation is Assets = Liabilities + Contributed Capital + Beginning Retained Earnings + Net Income - Dividends + Beginning Accumulated Other Comprehensive Income + Other Comprehensive Income.

Answer the following statement true (T) or false (F)

If the addition of a constraint to a linear programming problem does not change the solution, the constraint is said to be

A) unbounded. B) non-negative. C) infeasible. D) redundant. E) bounded.

What is the coupon payment of a 15-year $10,000 bond with a 9% coupon rate with semiannual payments?

A) $150.00 B) $450 C) $900.00 D) $1800.00

The primary output of risk identification is the Risk Identification Matrix (RIM)

Indicate whether the statement is true or false