The Gramm-Leach-Bliley Act of 1999

A) allowed the creating of financial holding companies.

B) set conditions under which an FHC can set up a merchant bank.

C) brings the U.S. closer to the universal banking model.

D) does all of the above.

D

You might also like to view...

The main effect of a decrease in labor demand that arises from a decrease in capital stock is

A) lower real wages. B) shifts in unemployment. C) a need for fewer immigrant workers. D) companies make fewer profits.

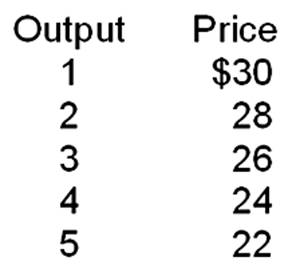

The marginal revenue that would be derived from producing the fourth unit of output is

A. $24.

B. $22.

C. $20.

D. $18.

Which of the following statements is most accurate about the Internet and tech companies?

A. The markets they operate in are monopolistically competitive. B. Firms that dominate one market will use large profits from that industry to put competitive pressure on rivals in other markets. C. The most dominant firms in each market only hold about 30 percent of the market share. D. Collusion among firms means that each industry is fully monopolized.

Social Security taxes are currently invested in

A. a mix of conservative stocks and bonds. B. money market accounts and certificates of deposit. C. U.S. Treasury bonds. D. gold.