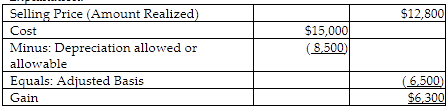

Joan bought a business machine for $15,000. In a later year, she sold the machine for $12,800 when the total allowable depreciation is $8,500. The depreciation actually taken on the tax returns totaled $8,000. Joan must recognize a gain (or loss) of

A) no gain or loss.

B) ($3,200).

C) $6,800.

D) $6,300.

D) $6,300.

You might also like to view...

A company recognizes the need for a new system to handle customer enquiries. During the buying process, who is most likely to be concerned with the return on investment (ROI)?

A) the initiator B) the user C) the decider D) the purchaser

If input and processing controls are adequate, why are output controls needed?

Goods in possession of bailees are considered to be in transit

Indicate whether the statement is true or false

?Which of the following mathematical expressions is used to compute the percentage rate of return on a bond?

A. ?Current Yield + Coupon Rate of Interest B. ?Current Yield + Capital Gains Yield C. ?Market Return + Maturity Value D. Market Yield + Current Yield? E. ?Market Yield + Capital Gains Yield