Answer the question.You must decide whether to buy a new car for $26,000 or lease the same car over a three-year period. Under the terms of the lease, you make a down payment of $1600 and have monthly payments of $320. At the end of three years, the leased car has a residual value (the amount you pay if you choose to buy the car at the end of the lease period) of $15,000. Assume you sell the new car at the end of three years at the same residual value. Compare the cost of leasing and buying the car.

A. Buy $11,000, lease $13,420

B. Buy $12,000, lease $13,120

C. Buy $11,000, lease $12,820

D. Buy $11,000, lease $13,120

Answer: D

You might also like to view...

What did Jean Piaget call the process by which changes occur in the existing way a child thinks in response to encounters with new stimuli or events?

A. assimilation B. accommodation C. cognition D. schemes

?All of the following are conditions for an annuity due except

A. ?periodic cash flows must be equal in amount. B. ?the time periods between the cash flows are the same length. C. ?the interest rate is constant for each time period. D. ?interest is compounded at the end of each time period.

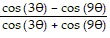

Complete the identity. = ?

= ?

A. cot (6?) B. 0 C. tan (3?) tan (6?) D. -tan (6?)

Answer the question.Many insurance companies carry a deductible provision that states how much of a claim you must pay out of pocket before the insurance company pays the remaining expenses. Suppose you have a car insurance policy with a $800 deductible provision (per claim) for collisions. During a two-year period, you file claims for $650 and $1200. The annual premium for the policy is $450. Determine how much you would pay with and without the insurance policy.

A. With policy $2500, without policy $1850 B. With policy $1950, without policy $2000 C. With policy $1900, without policy $1850 D. With policy $2350, without policy $1850