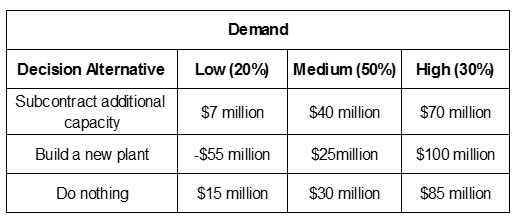

XYZ is a paint product manufacturer, and one of the plants is experiencing a substantial increase in demand. The future demand for the products could be low, medium, or high, with probabilities estimated to be 25%, 50%, and 30%, respectively. The company wants to determine the financial impact associated with the three decision alternatives under the varying levels of demand. Given the following payoff matrix, compute the expected regret for the option of building a new plant.

A. $10.6 million

B. $21.5 million

C. $9.5 million

D. $14 million

B. $21.5 million

You might also like to view...

A basic tenet of variable costing is that fixed overhead costs should be currently expensed. What is the basic rationale behind this procedure?

a. Fixed overhead costs will occur whether or not production occurs and so it presents a clearer picture of how changes in production volume affect costs and income. b. Fixed overhead costs are generally immaterial in amount and the cost of assigning the amounts to specific products would outweigh the benefits. c. Allocation of fixed overhead costs is arbitrary at best and could lead to erroneous decisions by management. d. Fixed overhead costs are uncontrollable and should not be charged to a specific product.

Executive officers' compensation is typically comprised of all of the following except

a. incentive bonuses. b. declared dividends. c. stock option awards. d. annual base salaries.

To avoid supply chain problems, firms must manage relationships with their downstream suppliers as well as their upstream customers

Indicate whether the statement is true or false.

According to Table 8-7, which describes an investment problem, which of the following would be the most appropriate constraint in the linear programming problem?

A) 0.06C + 0.13S + 0.08M ? 200000 B) C + S + M ? 200000 C) C + S + M ? 200000 D) C + S + M = 200000 E) None of the above