Ed's Electronic Devices has an asset beta of 1.2. The market rate of return is 12% and the risk-free rate of return is 2%. Ed is considering updating his production technology

If he does so, he expects the cash streams indicated in the table below. Given this information, should Ed update his production technology? Year Cashflow Present Value 0 -$100,000 1 $25,000 2 $25,000 3 $25,000 4 $25,000 5 $25,000 6 $25,000 Total

The present value of the cash flow is given in the table below. As indicated in the table, the net present value of the cash flow is negative. This implies that Ed should not update his production technology.

Year Cash Flow Present Value

0 -$100,000 -$100,000

1 $25,000 $21,929.824

2 $25,000 $19,236.688

3 $25,000 $16,874.287

4 $25,000 $14,802.007

5 $25,000 $12,984.217

6 $25,000 $11,389.664

Total -$2,783.32

You might also like to view...

Which of the following explains the cause of the change in the unemployment rate at the end of a recession?

A) Firms are hesitant to rehire laid off workers as they continue to operate below capacity. B) Discouraged workers leave the labor force, and this makes the unemployment rate rise. C) Discouraged workers return to the labor force, and this makes the unemployment rate fall. D) Firms rapidly hire new workers at the first sign of an increase in demand for their goods.

The United States dollar has NOT been officially convertible to gold by international traders since

A) 1930. B) 1944. C) 1971. D) 1995.

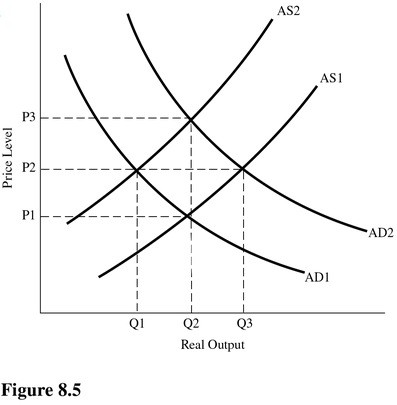

Using Figure 8.5, if the equilibrium price level is P1, then aggregate demand is

Using Figure 8.5, if the equilibrium price level is P1, then aggregate demand is

A. AD2, and the equilibrium output level is Q2. B. AD2, and the equilibrium output level is Q1. C. AD1, and the equilibrium output level is Q2. D. AD1, and the equilibrium output level is Q3.

________ are likely a fixed cost of a firm.

A. Travel expenses to meet with clients B. Lease payments for office space C. The payments for supplies D. Wages paid to employees