Assume a U.S. firm invests $1,500 to buy a one-year U.K. bond. What is the dollar value of the proceeds if the dollar return on the U.K. bond is 20 percent at maturity?

a. $1,800

b. $1,500

c. $1,200

d. $1,000

e. $500

a

You might also like to view...

Total physical product shows what happens to the quantity of a firm’s output when that firm changes the quantity of an input in the production process.

Answer the following statement true (T) or false (F)

An import quota specifies

A) the amount of funds that can be paid for any imported good. B) the amount of taxes that must be paid on any imported good. C) the maximum amount of an item that may be imported during a specified period. D) the minimum amount of an item that may be imported during a specified period.

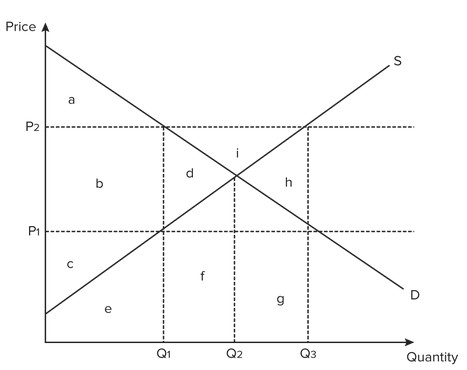

Use the figure below to answer the following question. If a price floor in this market is set at P1, then

If a price floor in this market is set at P1, then

A. deadweight loss equals area h. B. no deadweight loss occurs. C. deadweight loss equals area d. D. more information is needed to find deadweight loss.

The distance between the supply curve and the price the producer receives for a product for a given quantity supplied is referred to as:

A. market surplus. B. consumer surplus. C. producer surplus. D. market shortage.