You receive a paycheck from your employer, and your pay stub indicates that $400 was deducted to pay the FICA (Social Security/Medicare) tax. Which of the following statements is correct?

a. This type of tax is an example of a payback tax.

b. Your employer is required by law to pay $400 to match the $400 deducted from your check.

c. The $400 that you paid is the true burden of the tax that falls on you, the employee.

d. All of the above are correct.

b

You might also like to view...

The fact that output gaps will not last indefinitely, but will be closed by rising or falling inflation is the economy's:

A. income-expenditure multiplier. B. self-correcting property. C. short-run equilibrium property. D. long-run equilibrium property.

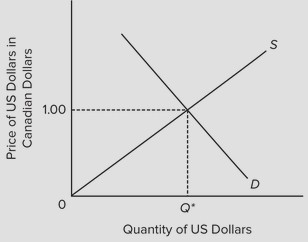

Use the following graph to answer the next question. All else held constant, higher inflation in the United States relative to that in Canada will cause a(n) ________.

All else held constant, higher inflation in the United States relative to that in Canada will cause a(n) ________.

A. decrease in the supply of U.S. dollars B. decrease in the value of the U.S. dollar in terms of the Canadian dollar C. increase in the value of the U.S. dollar in terms of the Canadian dollar D. increase in the demand for U.S. dollars

If consumption spending is larger than disposable income,

a. saving is positive. b. dissaving occurs. c. saving is exactly zero. d. a depression results. e. this cannot occur.

"If all economists were laid end to end, they would not reach a conclusion.". Who made this whimsical observation?

a. Harry Truman b. George Bernard Shaw c. John Maynard Keynes d. Ronald Reagan