When the Fed buys bonds and injects additional reserves into the banking system, this action will

a. place downward pressure on short-term interest rates.

b. cause many decision makers to expect that the future rate of inflation will fall.

c. place upward pressure on both short-term and long-term interest rates.

d. place upward pressure on short-term interest rates and downward pressure on long-term interest rates.

A

You might also like to view...

If the economy receives an influx of new workers from immigration

A) the long-run aggregate supply curve will shift to the right. B) we will move down along the long-run aggregate supply curve. C) we will move up along the long-run aggregate supply curve. D) the long-run aggregate supply curve will shift to the left.

The best example of recessions being close to each other in the United States can be found in the

a. 1980s. b. 1970s. c. 1990s. d. 2000s.

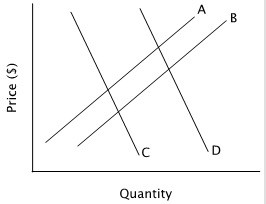

Refer to the accompanying figure. An increase in supply is represented by a shift from:

A. curve C to curve D. B. curve B to curve A. C. curve A to curve B. D. curve C to curve B.

Which of the following occur in the real world?

A. Both market failures and government failures B. Market failures but not government failures C. Government failures but not market failures D. Neither market failures nor government failures