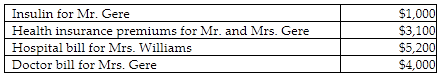

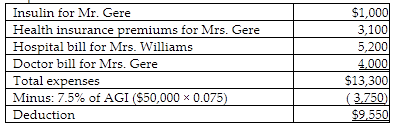

Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000 in 2018. During the tax year, they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's could claim Mrs. Williams as their dependent, but she has too much gross income.

A) $5,200

B) $8,300

C) $9,550

D) $13,300

C) $9,550

You might also like to view...

The source of the Statute of Frauds today is a federal statute

Indicate whether the statement is true or false

The parent who has legal custody of a child has:

A) The right to make day-to-day decisions concerning the child's matters. B) The physical custody of the child as well, generally. C) Both of the above. D) None of the above.

A(n) ________ game occurs when each player selects an optimal strategy that does not result in an equilibrium point when the minimax criterion is used

A) optimal strategy B) pure strategy C) mixed strategy D) best strategy

An accountant who acts in a reasonably competent and professional manner is an insurer of the accuracy of her report

Indicate whether the statement is true or false