Suppose you sold 20 futures contracts at a price of $5.00 per bushel and suppose the maintenance margin is $1300 per contract. At the end of the first trading day when the price fell from $5.00 to $4.80 per bushel, the amount of the margin call you had to make is

A. $0

B. $10,000

C. $20,000

D. $6,000.

Ans: A. $0

You might also like to view...

Suppose an economy has the following production function: Y = A × K1/4 × H3/4. Which of the following is true of this economy?

A) Production in this economy exhibits increasing returns to scale. B) Production in this economy exhibits decreasing returns to scale C) Production in this economy exhibits constant returns to scale. D) Production in this economy decreases when the price level increase.

The short-run Phillips curve tradeoff becomes less favorable if either

A) the expected inflation rate or the natural unemployment rate increases. B) potential GDP or the natural unemployment rate increases. C) potential GDP or the natural unemployment rate decreases. D) the level of real GDP decreases or the natural unemployment rate decreases. E) the expected inflation rate increases or the natural unemployment rate decreases.

Product differentiation and internal economies of scale yield gains from trade in the form of

A) lower production costs and a greater variety of goods. B) higher profits and lower trade costs. C) the proximity-concentration effect. D) a proliferation of competitive firms. E) the substitution of immigration for foreign direct investment.

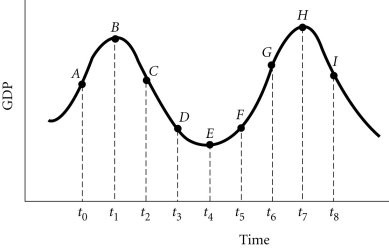

Refer to the information provided in Figure 29.1 below to answer the question(s) that follow. Figure 29.1Refer to Figure 29.1. If policy makers decide at time t5 that the economy is expanding too fast, but the policy changes start affecting the economy at t7, then the policy will be

Figure 29.1Refer to Figure 29.1. If policy makers decide at time t5 that the economy is expanding too fast, but the policy changes start affecting the economy at t7, then the policy will be

A. optimal. B. ineffective. C. inappropriate. D. well timed.