According to the Laffer curve, increases in the tax rate will lead to a(n)

A) steady decrease in tax revenues.

B) steady increase in tax revenues.

C) initial decrease in tax revenues and then an increase in tax revenues.

D) initial increase in tax revenues and then a decrease in tax revenues.

D

You might also like to view...

Refer to Table 14-1. What is the Nash equilibrium in this game?

A) Star Connections increases its advertising budget, but Godrickporter does not. B) There is no Nash equilibrium. C) Both Godrickporter and Star Connections increase their advertising budgets. D) Godrickporter increases its advertising budget, but Star Connections does not.

If the expected inflation rate is unchanged, a fall in the natural rate of unemployment would

A) shift the short-run Phillips curve to the right. B) not shift the short-run Phillips curve. C) shift the short-run Phillips curve to the left. D) shift the short-run Phillips curve to the left and shift the long-run Phillips curve to the right.

The following question relates to an oligopoly market where the industry demand curve is P = 100 - Q. Derive the reaction curve for a Cournot duopolist where the industry demand curve is as stated above and the MC of production is zero.

What will be an ideal response?

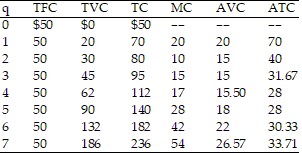

Refer to the data provided in Table 9.2 below to answer the question(s) that follow.

Table 9.2 Refer to Table 9.2. The market price is $42 and this firm is producing four units of output. Which of the following would you recommend to this firm?

Refer to Table 9.2. The market price is $42 and this firm is producing four units of output. Which of the following would you recommend to this firm?

A. Increase output to six units so that marginal cost equals marginal revenue. B. Reduce price to $17 so that marginal cost will equal marginal revenue at 4 units of output. C. Increase output to seven units so that price is less than marginal cost. D. Continue producing four units of output, because the firm is able to make an economic profit.