Assume that the uncovered interest parity condition holds. Also assume that the U.S. interest rate is less than the U.K. interest rate. Given this information, we know that investors expect

A) the pound to depreciate.

B) the pound to appreciate.

C) the dollar-pound exchange rate to remain fixed.

D) the U.S. interest rate to fall.

E) none of the above

A

You might also like to view...

Assume that the central bank sells government securities in the open market. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the current international transactions balance and monetary base in the context of the Three-Sector-Model? State your answer after the macroeconomic system returns to complete equilibrium. a. The current

international transactions balance becomes more positive (or less negative) and monetary base rises. b. The current international transactions balance becomes more negative (or less positive) and monetary base falls. c. The current international transactions balance and monetary base more negative (or less positive). d. The current international transactions balance and monetary base remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

Central Banks

What will be an ideal response?

The long-run aggregate supply curve would shift left if the amount of labor available

a. increased or Congress made a substantial increase in the minimum wage. b. decreased or Congress abolished the minimum wage. c. increased or Congress abolished the minimum wage. d. decreased or Congress made a substantial increase in the minimum wage.

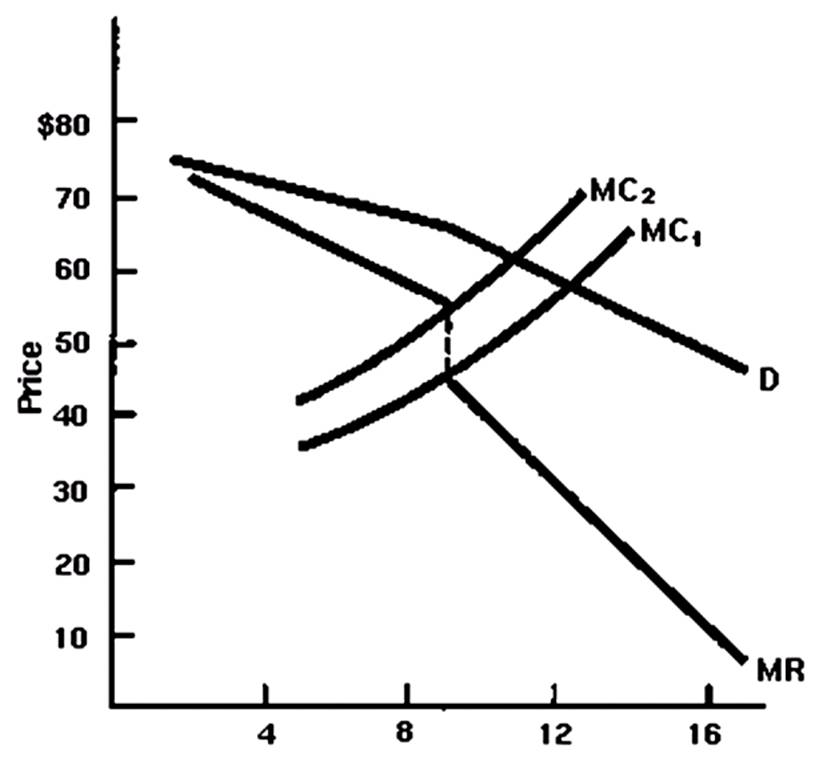

The price charged by this profit-maximizing firm is ___ and its output is ___ (assume marginal cost is MC1).

A. $45; 9

B. $45; 11

C. $65; 9

D. $65; 11