Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

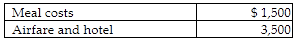

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in attending the conference and taking potential customers to lunch and dinner to discuss book sales.

A) Reimbursement-exclude from income; unreimbursed expenses-no deduction allowed

B) Reimbursement-exclude from income; unreimbursed expenses-deduct within itemized deductions, after 50% reduction for meal portion

C) Reimbursement-include in income; unreimbursed expenses-no deduction allowed

D) Reimbursement-include in income; unreimbursed expenses-deduct within itemized deductions, after 50% reduction for meal portion

A) Reimbursement-exclude from income; unreimbursed expenses-no deduction allowed

Since there was an accountable plan, the reimbursement is not included in income. Excess costs are not deductible by employees.

You might also like to view...

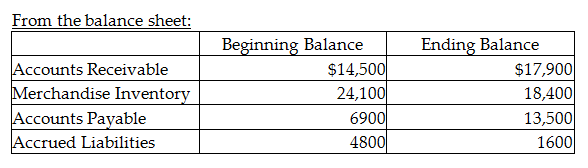

What amount will be shown for payments to suppliers for Merchandise Inventory purchases? (Assume that Accounts Payable are for purchases of merchandise inventory only.)

Designer Paints Company uses the direct method for preparing its statement of cash flow. Designer Paints reports the following information regarding 2018:

From the income statement:

Sales Revenues, $267,000

Cost of Goods Sold, $213,000

Operating Expenses, $33,000

A) $207,300

B) $213,900

C) $200,700

D) $212,100

Which of the following is a not a reason for a business combination to take place?

A. Diversification of business risk. B. Vertical integration. C. Increase in stock price of the acquired company. D. Cost savings through elimination of duplicate facilities. E. Quick entry for new and existing products into domestic and foreign markets.

Inventory cycle time is the frequency of inventory replacement.

Answer the following statement true (T) or false (F)

Anna works for a company that has five employees. To which type of notice or pay in lieu of noticedoes she have the option to claim if fired?

A) termination under employment standards legislation B) severance under employment standards legislation C) notice under the common law D) A and C E) All of the above