Suppose the Fed wants to increase the money supply. The most frequent way used to do this is

a. increase the discount rate

b. decrease the prime rate

c. buy US corporate stock from banks

d. buy US govt bonds from banks

Ans: d. buy US govt bonds from banks

You might also like to view...

According to the Ricardian equivalence proposition, current deficits

A) will not affect consumption or national saving. B) will affect consumption but not national saving. C) will affect national saving but not consumption. D) will affect both consumption and national saving.

The volume of loans that the Fed makes to banks is affected by the Fed's setting of the interest rate on these loans, called the

A) federal funds rate. B) prime rate. C) discount rate. D) interbank rate.

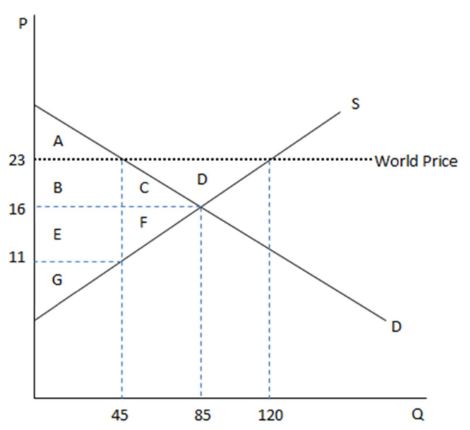

According to the graph shown, if this economy were to open to trade, surplus would:

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good.

A. increase overall.

B. decrease for the producer.

C. transfer from producer to consumer.

D. increase for the consumer.

Rising prices help control the process of resource depletion by

a. discouraging consumption and waste. b. stimulating more efficient use of the depletable resource. c. encouraging resource-saving innovation. d. doing all of the above.