A family that earns $20,000 a year pays $400 a year in taxes on clothing. A family that earns $40,000 a year pays $200 a year in taxes on clothing. The tax on clothing is

A. a progressive tax.

B. a regressive tax.

C. a proportional tax.

D. a benefits-received tax.

Answer: B

You might also like to view...

Pre-merger notification requirements make merger policy more like a regulatory process

Indicate whether the statement is true or false

Holding everything else unchanged, higher interest rates in foreign countries relative to interest rates

A) increase the demand and reduce the supply of dollars leading to an increase in the exchange rate. B) decrease the demand and the supply of dollars leading to an decrease in the exchange rate. C) increase the demand and the supply of dollars leading to an increase in the exchange rate. D) decrease the demand and increase the supply of dollars leading to a decrease in the exchange rate

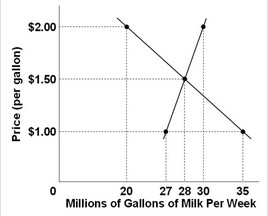

Use the following graph of the market for milk to answer the question below. If 30 million gallons of milk are being produced, then we know

If 30 million gallons of milk are being produced, then we know

A. too much milk is being produced. B. too little milk is being produced. C. marginal benefit is $1.00. D. marginal benefit is greater than marginal cost.

Constant dollars are

A. the same as current dollars. B. when an individual does not receive a cost of living increase. C. what nominal GDP is measured in. D. dollars corrected for general price level changes.