A bank can reduce its total amount of loans outstanding by

A) "calling in" loans; that is, by not renewing some loans when they come due.

B) selling loans to other banks.

C) selling loans to the Federal Reserve.

D) doing all of the above.

E) doing only A and B of the above.

E

You might also like to view...

In which of the following cells in the sustainability matrix is the organization making a substantial social impact but may have inadequate funding to sustain this level of activity?

A) Cell 1 B) Cell 2 C) Cell 3 D) Cells 3 and 4 E) Cells 1 and 2

On January 1, Year 1, Jones Company issued bonds with a $240,000 face value, a stated rate of interest of 8.5%, and a 5-year term to maturity. The bonds were issued at 99. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method.What is the amount of cash outflow from operating activities shown on Jones' statement of cash flows for the year ending December 31, Year 2?

A. $19,920 B. $20,400 C. $20,880 D. $21,360

Christine has just answered a prospect's question about some negative publicity her product received. To find out if her prospect has any more objections with which she should deal, Christine should:

A. lead into a benefit. B. use a trial close. C. use the questions approach. D. begin her demonstration. E. hand her catalog to the prospect.

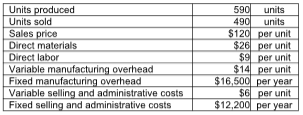

There are no beginning inventories. What is the ending balance in Finished Goods Inventory using variable costing?

McFarlane, Inc. reports the following information:

A) $4900

B) $3500

C) $5500

D) $7697