Suddeth Corporation has entered into a 6 year lease for a building it will use as a warehouse. The annual payment under the lease will be $2,468. The first payment will be at the end of the current year and all subsequent payments will be made at year-ends. If the discount rate is 5%, the present value of the lease payments is closest to (Ignore income taxes.):Refer to Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided.

A. $12,528

B. $14,103

C. $11,050

D. $14,808

Answer: A

You might also like to view...

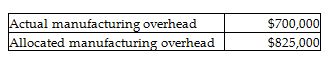

Davie, Inc. used estimated direct labor hours of 240,000 and estimated manufacturing overhead costs of $1,150,000 in establishing its predetermined overhead allocation rate for the year. Actual results showed the following:

What was the number of direct labor hours worked during the year? (Round any intermediate calculations to two decimal places, and your final answer to the nearest whole number.)

A) 146,087 hours

B) 282,857 hours

C) 240,084 hours

D) 172,234 hours

Zebra, Inc. cost of goods sold for the year is $2,300,000, and the average merchandise inventory for the year is $139,000. Calculate the inventory turnover ratio of the company. (Round your answer to two decimal places.)

A) 6.04 times B) 16.55 times C) 8.27 times D) 93.96 times

A fixed-term tenancy is created when a lease does not specify its duration.

Answer the following statement true (T) or false (F)

Which of the following must be contained in a certificate of limited partnership under the Uniform Limited Partnership Act:

a. name of the business b. type or character of the business c. the address of an agent who is designated to receive legal process d. duration of the limited partnership e. all of the other choices are correct