Suppose there is only one gas station within hundreds of miles. The owner finds that when she charges $3 a gallon, she sells 199 gallons a day, and when she charges $2.99 a gallon, she sells 200 gallons a day. The owner, obviously, is ________ and the marginal revenue of the 200th gallon of gas is __________

a. a perfect competitor (because all gas stations are perfect substitutes); $.01

b. a monopolist; $1

c. a monopolist; $2.99

d. in monopolistic competition (because gas is perceived as a differentiated product); $3

e. in monopolistic competition (because gas is perceived as a differentiated product); $600

B

You might also like to view...

For a risk averse person, the marginal utility of wealth

A) decreases as wealth increases. B) increases as wealth increases. C) decreases as wealth decreases. D) remains constant as wealth increases.

In markets with asymmetric information

A) asymmetric information causes moral hazard and then it causes adverse selection. B) moral hazard causes adverse selection which in turn causes asymmetric information. C) asymmetric information causes adverse selection and then it causes moral hazard. D) adverse selection causes moral hazard which in turn causes asymmetric information.

Unlike perfect price discrimination, group price discrimination does NOT require

A) firms to have market power. B) the ability to distinguish between groups with different reservation prices. C) the ability to limit or prevent resale. D) None of the above.

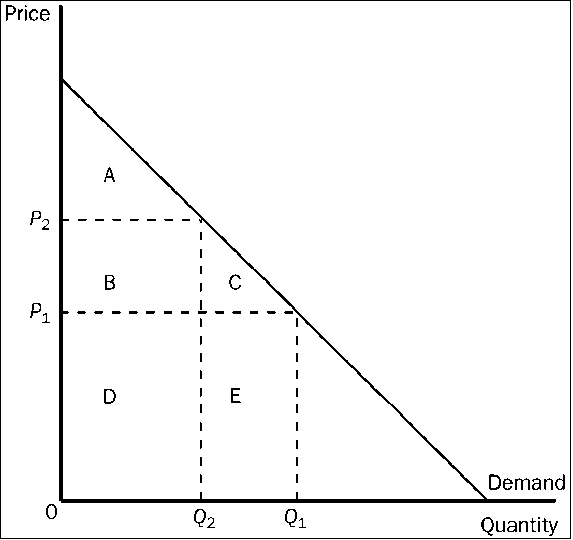

Figure 3-17

Refer to . When the price rises from P1 to P2, consumer surplus

a.

increases by an amount equal to A.

b.

decreases by an amount equal to B + C.

c.

increases by an amount equal to B + C.

d.

decreases by an amount equal to C.

v