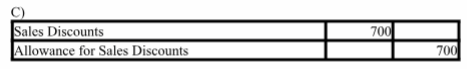

Netherland Corporation has the following unadjusted balances: Accounts Receivable, $80,000 (debit), and Allowance for Sales Discounts $300 (credit). Of the receivables, $50,000 of them are within the 2% discount period, and Netherland expects buyers to take $1,000 in future- period discounts ($50,000 × 2%) arising from this period’s sales. The adjusting entry to estimate sales discounts is (are):

Explanation: Allowance for Sales Discounts = $50,000 × .02 = $1,000 ? $300 = $700

You might also like to view...

If you have any ____ questions about our proposal, please contact us immediately

A) farther B) further

Trekker Bikes' current assets are $300 million and its current liabilities are $125 million. Its current ratio is 0.417.

Answer the following statement true (T) or false (F)

The World Health Organization's Framework Convention on Tobacco Control constitutes a comprehensive ban on:

a. tobacco sale. b. tobacco use in public places. c. tobacco advertising. d. All of the above

Anything that can be owned is considered property. Three categories of property identified in the text are ____________________ property, ____________________ personal property, and ____________________ personal property.

Fill in the blank(s) with the appropriate word(s).