Suppose that the interest rate available to you on a long-term bond is 4 percent. If you hold $1,000 of your wealth in currency instead of in the form of a bond, the annual opportunity cost is

A) $0.04. B) $4. C) $40. D) $400.

C

You might also like to view...

If the Fed wanted to decrease the money supply, one way to make an enormous impact would be to:

A. decrease the reserve requirement, which would increase the money multiplier. B. increase the reserve requirement, which would decrease the money multiplier. C. increase the reserve requirement, which would increase the money multiplier. D. decrease the reserve requirement, which would decrease the money multiplier.

The coupon rate for a coupon bond is equal to the:

A. purchase price of the bond divided by the coupon payment. B. annual coupon payment divided by the selling price of the bond. C. annual coupon payment divided by the face value of the bond. D. annual coupon payment divided by the purchase price of the bond.

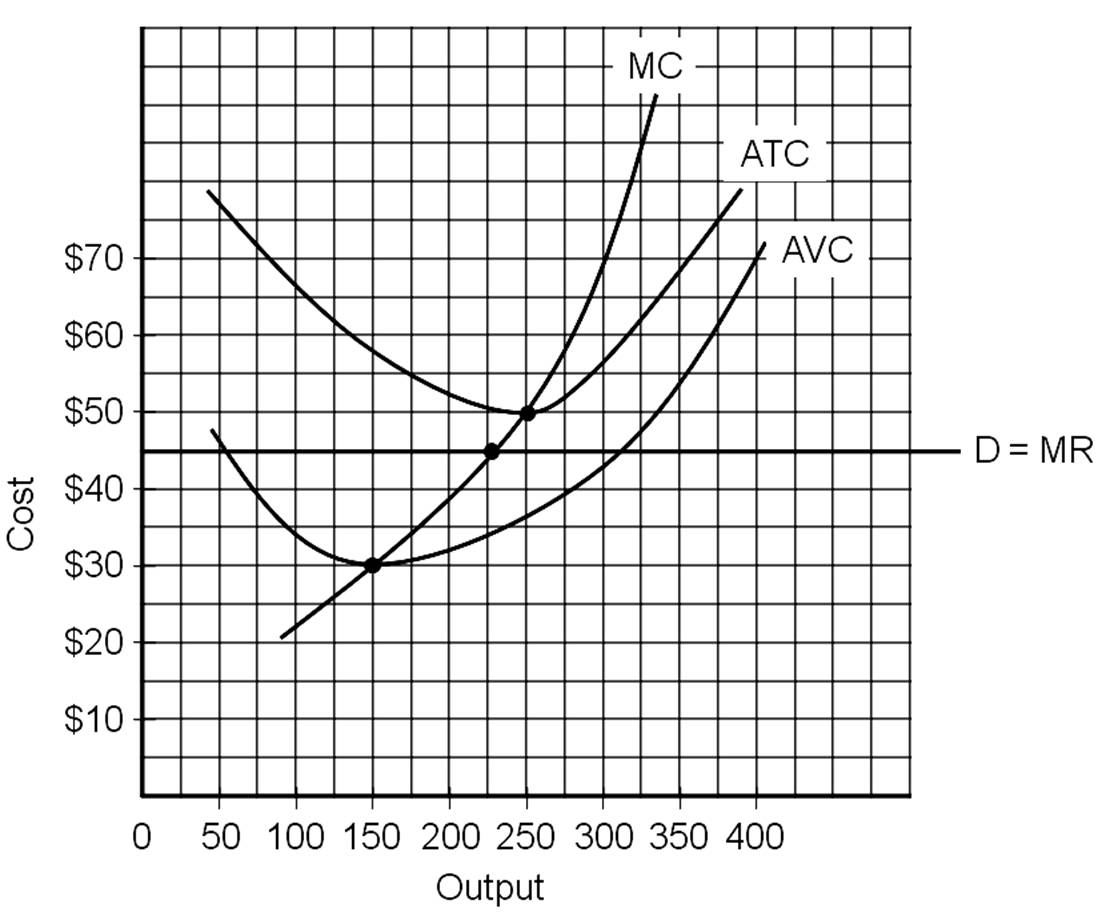

The firm's most profitable output is at

A. 150.

B. 175.

C. 225.

D. 300.

Wages and salaries (including wage supplements) accounted for ________ of personal income in the United States in 2017.

A. 37% B. 50% C. 63% D. 90%