Suppose Winston's annual salary as an accountant is $60,000, and his financial assets generate $4,000 per year in interest. One day, after deciding to be his own boss, he quits his job and uses his financial assets to establish a consulting business, which he runs out of his home. To run the business, he outlays $8,000 in cash to cover all the costs involved with running the business, and earns revenues of $150,000. What costs would be considered when calculating accounting profit?

A. The opportunity cost of his job and interest forgone of $64,000, and the explicit cost of $8,000

B. The implicit cost of the interest forgone of $4,000 and the explicit cost of $8,000

C. The explicit cost of $8,000

D. The implicit cost of his job of $60,000 and the opportunity cost of forgone interest of $4,000

C. The explicit cost of $8,000

You might also like to view...

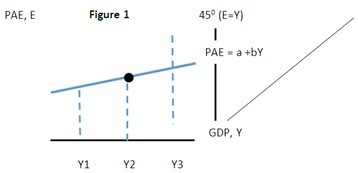

In the figure above, if the MPC increased, the aggregate expenditure lines would ________ and the multiplier would ________ in value

A) not change; rise B) become steeper; fall C) not change; fall D) become steeper; rise E) become less steep; rise

Balanced budget multiplier (= +5 - 4 = 1. Thus the impact on economic equilibrium is exactly equal to the original change in government spending (and taxes). So we can say that ?Y = ?G.**)

What will be an ideal response?

In Figure 1 above if the economy were at Y1 then we would expect there to be:

In Figure 1 above if the economy were at Y1 then we would expect there to be:

A. no change in inventories. B. an increase in inventories. C. a reduction in inventories. D. an increase in consumption spending.

If New York City expects that an increase in bus fares will raise mass transit revenues, it must think that the demand for bus travel is:

A. elastic. B. unit elastic. C. inelastic. D. perfectly inelastic.