A tax must be progressive if an individual with a higher income pays more dollars in taxes than an individual with a lower income.

Answer the following statement true (T) or false (F)

False

You might also like to view...

An inferior good is a good whose quantity demanded

A. rises when its price falls. B. falls when the price of a related good falls. C. falls when the consumer’s total utility rises. D. rises when the consumer’s real income falls.

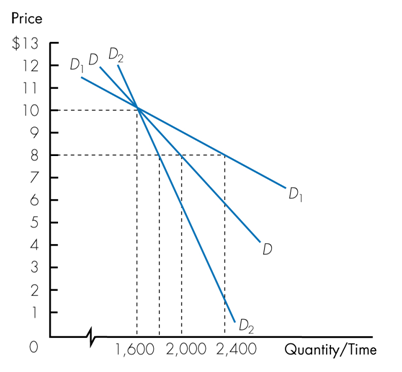

Refer to the following graph. When the price falls from $10 to $8, demand

a. is most elastic if the demand curve is D2.

b. is most elastic if the demand curve is D.

c. is most elastic if the demand curve is D1.

d. is most inelastic if the demand curve is D.

Within a system of perfectly flexible exchange rates, an decrease in the United States demand for imports would result in a

a. rise in the exchange rate. b. fall in the exchange rate. c. balance of payments deficit. d. balance of payments surplus.

A difficulty with using a uniform per-unit tax to address a negative externality is that

A) the tax will reduce output. B) the tax will increase price. C) the social cost of pollution might vary across geographic regions. D) the social cost of pollution should not be assessed on the consumers, but should be assessed on the firms.