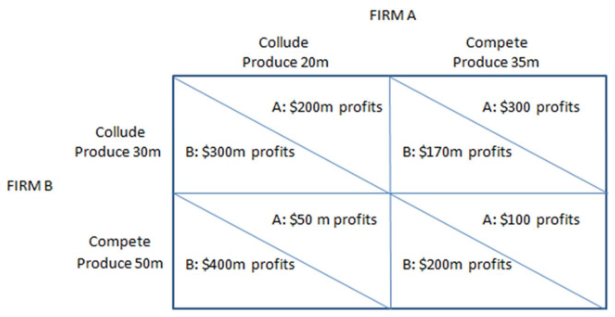

Given the situation in the matrix shown, the two firms are likely to collude only if:

This prisoner's dilemma game shows the payoffs associated with two firms, A and B, in an oligopoly and their choices to either collude with one another or not.

A. it is a repeated game.

B. they will only make the decision once.

C. The two firms will always choose to compete.

D. they are the only two firms with dominant market share.

A. it is a repeated game.

You might also like to view...

Suppose product price is fixed at $24; MR = MC at Q = 200; AFC = $6; AVC = $16 . What do you advise this firm to do?

a. Increase output. b. Decrease output. c. Shut down operations. d. Stay at the current output; the firm is earning a profit of $400. e. Stay at the current output; the firm is losing $200.

Which is most characteristic of a pure monopoly?

A. There is a dominant firm in a multifirm industry. B. Exit from the industry is blocked but entry into the industry is relatively easy. C. The firm produces a good or a service for which there are no close substitutes. D. The firm has considerable control over the quantity of the output produced, but not over price.

For this question, assume that the Fed sets monetary policy according to the Taylor rule. Suppose current U.S. macroeconomic conditions are represented by the following: ? = ??* and u < un. Given this information, we would expect that the Fed will

A) implement a monetary contraction. B) implement a monetary expansion. C) maintain its current stance of monetary policy. D) more information is need to answer this question.

Suppose two corporate bonds with similar risk pay different rates of return. The process of arbitrage should:

A. not affect their rates of return. B. increase the return on the asset with the higher rate of return as the demand for it increases. C. increase the gap between the two rates of return. D. eventually equalize their rates of return.