Which of the following statements is true?

A. The effectiveness of a board of directors in monitoring managers is enhanced by appointing members from the firm who are well-informed about the management problems facing the firm.

B. Shareholders as a group have little or no ability to force managers to pursue maximization of the firm's value.

C. Reducing the amount of debt financing can reduce divergence between the shareholders' interests and the manager's interests.

D. Equity ownership by managers is thought to be one of the most effective corporate control mechanisms.

E. All of the above are true.

Answer: D

You might also like to view...

A movement along the consumption function is the result of a change in

A) consumer wealth. B) income. C) autonomous consumption. D) expected wealth.

In order to reduce the likelihood of excessive leverage in the banking system, governments have traditionally

A) imposed capital requirements on commercial banks. B) imposed capital requirement on investment banks. C) imposed capital requirements on both commercial and investment banks. D) imposed asset requirements on all banks.

Corporate profits can be broken into three categories: dividends, undistributed profits, and corporate profits taxes

Indicate whether the statement is true or false

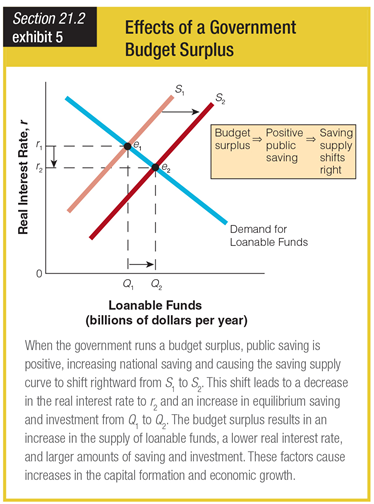

Based on the graph showing the effects of a government budget surplus, a budget surplus would ______.

a. increase the demand curve for loanable funds

b. decrease the demand curve for loanable funds

c. increase the supply curve for loanable funds

d. decrease the supply curve for loanable funds