Suppose elasticity of demand is 0.2, elasticity of supply is 0.7, and a 10 percent excise tax is levied on producers. Which of the following changes will reduce the share of the tax paid by consumers?

A. Elasticity of demand falls to 0.1.

B. Nothing will change the burden of the tax.

C. Elasticity of supply falls to 0.3.

D. The tax is increased to 20 percent.

Answer: C

You might also like to view...

One timing problem in using fiscal policy to counter a recession is the "legislative lag" that occurs between the

A. time the need for the fiscal action is recognized and the time that the action is taken. B. time fiscal action is taken and the time that the action has its effect on the economy. C. start of the recession and the time it takes to recognize that the recession has started. D. start of a predicted recession and the actual start of the recession.

Assume that the quantity consumed of pizza is dependent on three factors: the price of a pizza, the income of pizza purchasers, and consumers' taste for pizza

When graphing the relationship between the price of a pizza and the quantity of pizza consumed A) the price of a pizza and the income of pizza consumers are the only variables that are allowed to change. B) the price of pizza and quantity consumed of pizza are the only variables that are allowed to change. C) consumers' taste for pizza and the income of pizza purchasers are the only variables that are allowed to change. D) None of the above answers are correct.

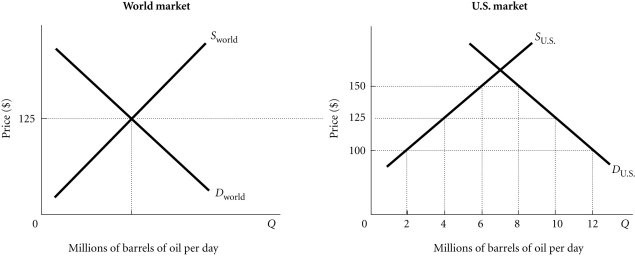

Refer to the information provided in Figure 4.4 below to answer the question(s) that follow. Figure 4.4Refer to Figure 4.4. Assume that initially there is free trade. To reduce U.S. imports without a tariff, the U.S. could

Figure 4.4Refer to Figure 4.4. Assume that initially there is free trade. To reduce U.S. imports without a tariff, the U.S. could

A. allow drilling for oil in the Alaska National Wildlife Refuge. B. increase pollution control regulations. C. increase safety regulations for oil refineries. D. all of the above

Related to the Economics in Practice on page 154: According to the Economics in Practice feature, the managerial part of the United States Technical Assistance and Productivity Program

A. generated large short-term effects but barely any long-lasting effects. B. generated large and long-lasting positive effects. C. was not effective in either the long run or the short run. D. generated only small positive effects in both the short and long run.