The market where currencies may be bought and sold for immediate delivery is known as

A) the forward exchange market.

B) the spot exchange market.

C) the purchasing power market.

D) the futuristic exchange market.

B

You might also like to view...

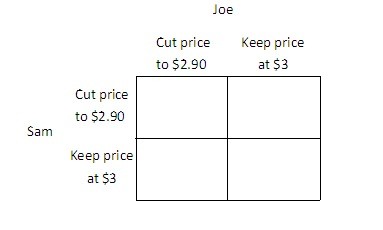

Joe is the owner of the 7-11 Mini Mart, Sam is the owner of the SuperAmerica Mini Mart, and together they are the only two gas stations in town. Currently, they both charge $3 per gallon, and each earns a profit of $1,000. If Joe cuts his price to $2.90 and Sam continues to charge $3, then Joe's profit will be $1,350, and Sam's profit will be $500. Similarly, if Sam cuts his price to $2.90 and Joe continues to charge $3, then Sam's profit will be $1,350, and Joe's profit will be $500. If Sam and Joe both cut their price to $2.90, then they will each earn a profit of $900. You may find it easier to answer the following questions if you fill in the payoff matrix below.

width="383" />In this situation, the Nash equilibrium yields a: A. lower payoff than each would receive if each played his dominated strategy. B. the same payoff that each would receive if each played his dominated strategy. C. lower payoff than each would receive if each played his dominant strategy. D. higher payoff than each would receive if each played his dominant strategy.

Perfectly competitive markets feature relatively high barriers to entry.

Answer the following statement true (T) or false (F)

What are the costs and benefits of foreign trade?

What will be an ideal response?

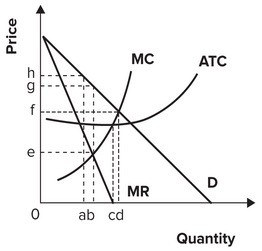

Refer to the graph shown. At an output of a, the monopolist should:

A. reduce output to increase profits. B. not change output since profits are maximized. C. increase price to increase profits. D. increase output to increase profits.