What is the price of a coupon bond that has annual coupon payments of $85, a par value of $1000, a yield to maturity of 10%, and a maturity of three years?

A) $211.38

B) $898.84

C) $962.70

D) $1255.0

C

You might also like to view...

A price ceiling in the market for fuel oil that is below the equilibrium price will

A) lead to the quantity supplied of fuel oil exceeding the quantity demanded. B) lead to the quantity demanded of fuel oil exceeding the quantity supplied. C) decrease the demand for fuel oil. D) increase the supply of fuel oil. E) have no effect in the market for fuel oil.

If a firm hires labor for $20,000, pays rent of $12,000, buys raw materials for $6,000 from another firm, earns profits of $3,000, and sells its output for $41,000, the value added by the firm is _____

a. $0 b. $15,000 c. $35,000 d. $38,000 e. $41,000

During 2008-2013, the Fed initiated several rounds of "quantitative easing.". Under this policy, the Fed

a. increased its purchases of financial assets and thereby injected additional reserves into the banking system. b. increased its purchases of financial assets, which reduced the reserves available to the banking system. c. reduced its purchases of financial assets and thereby injected additional reserves into the banking system. d. reduced its purchases of financial assets and thereby reduced the quantity of reserves available to the banking system.

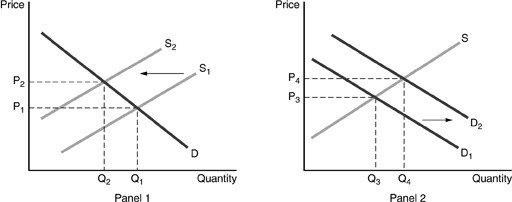

A shift from S1 to S2 reflects the change that happens when a negative externality is taken into account. A shift from D1 to D2 reflects the change that happens when a positive externality is taken into account.Refer to the above figures. If a positive externality that existed becomes corrected, price and quantity will become

A shift from S1 to S2 reflects the change that happens when a negative externality is taken into account. A shift from D1 to D2 reflects the change that happens when a positive externality is taken into account.Refer to the above figures. If a positive externality that existed becomes corrected, price and quantity will become

A. P1 and Q1. B. P2 and Q2. C. P3 and Q3. D. P4 and Q4.