A change in the reserve requirement is the tool used least often by the Fed because it:

A. Does not affect bank reserves.

B. Can cause abrupt changes in the money supply.

C. Does not affect the money multiplier.

D. Has no impact on the lending capacity of the banking system.

B. Can cause abrupt changes in the money supply.

You might also like to view...

Starting from long-run equilibrium, an increase in autonomous investment results in ________ output in the short run and ________ output in the long run.

A. lower; potential B. higher; higher C. lower; higher D. higher; potential

According to the data in the table above,

A) the standard of living worsened between year 1 and year 2. B) the standard of living improved between year 1 and year 2. C) real GDP grew more slowly than population between year 1 and year 2. D) as measured by real GDP per person, the standard of living remained the same between year 1 and year 2. E) real GDP grew more rapidly than population between year 1 and year 2.

A movement downward along the demand for loanable funds curve occurs when

A) the expected profit from investment increases. B) business expectations become more optimistic. C) the real interest rate falls. D) the supply of loanable funds decreases.

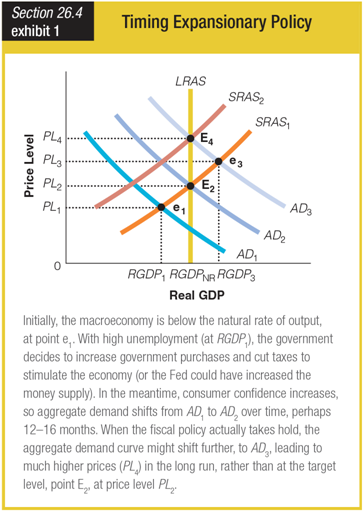

Which of the following causes a shift from E3 to E4?

a. price increase in the long run

b. price increase in the short run

c. price decrease in the long run

d. price decrease in the short run